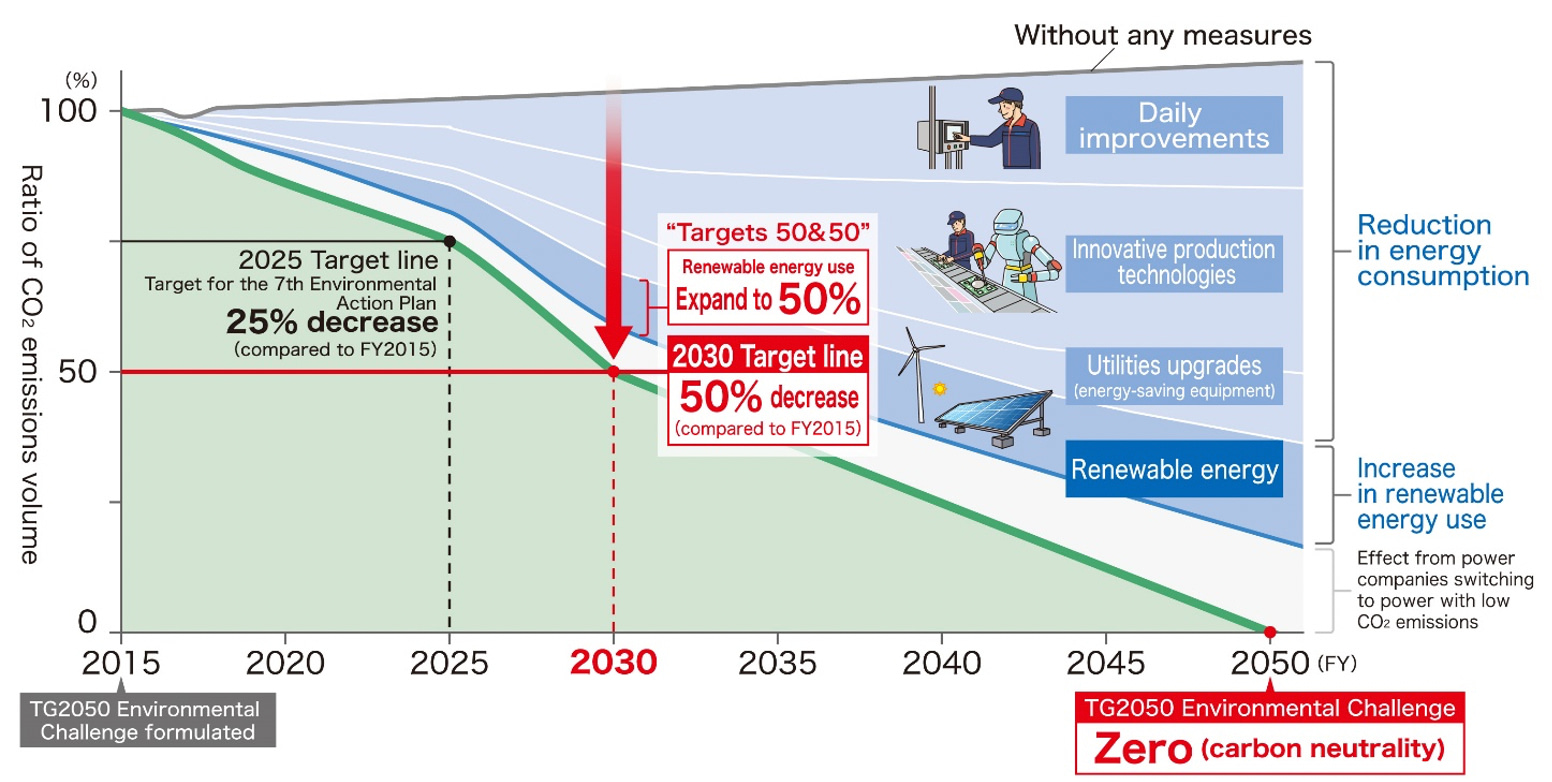

Kiyosu, Japan, April 5, 2021: Toyoda Gosei Co., Ltd. has formulated new medium and long-term CO2 reduction targets it calls “Targets 50 & 50.” It has also set CO2 reduction targets in its 7th Environmental Action Plan1 covering the five years until 2025, and is accelerating efforts for decarbonization.

In moving toward carbon neutrality, Toyoda Gosei set the target of zero CO2 emissions by 2050 in its TG 2050 Environmental Challenge. As a milestone on the way to that goal, it aims to cut CO2 emissions in half by 2030 compared with FY2015 levels. A major part of that effort will be to increase the use of electricity from renewable sources to 50%. These are Toyoda Gosei’s Targets 50 & 50—a 50% decrease in CO2 emissions and 50% renewable energy use. The company is introducing power facilities that use green energy sources and energy-saving production equipment at each plant, implementing production technology innovations such as more compact equipment, and developing products for electric vehicles to increase efficiency. As a target for 2025, it aims to cut CO2 emissions by 25% (compared with FY2015 levels) based on the 7th Environmental Action Plan.

To fulfill its responsibility to explain the risks and opportunities brought about by climate change for its business to stakeholders, the company has completed disclosure of recommended items2 based on the proposals of the Task Force on Climate-related Financial Disclosures (TCFD).3

To help stakeholders better understand Toyoda Gosei’s efforts in this area, the company held an ESG briefing for institutional investors on April 5.

Toyoda Gosei will continue to make its business activities more environment-friendly in helping to bring about a sustainable society.

1 Targets include reducing CO2 emissions by 25% compared with 2015 levels.

2 Also posted on the company’s website

3 An organization that seeks disclosure of financial information related to companies’ efforts or impacts with respect to climate change. The awareness that climate change affects financial markets is spreading, and TCFD was established by the Financial Stability Board comprising the financial authorities of major countries.

Plan for achieving carbon neutrality